In microfinance or a Sacco, dividend is the sum of money that you pay regularly to your members out of your profits or reserves.

You may pay dividends monthly, quarterly, semi-annually, or annually depending on the policy that you’ve set in your Sacco. However, in most cases, dividends are paid out only once a year during the Annual General Meeting(AGM).

In other words, a dividend is like a share of profit that you give to the members of a Sacco to encourage them to save and invest their money.

In this guide, you’ll use the flat rate and pro-rata basis methods to calculate dividends in a Sacco.

Prerequisites

Before you begin, ensure you have the following:

- A list of all members and their total contributions for the year

- Total profit made by the microfinance bank in the current year from the profit and loss account.

Method 1 – Flat Rate Method for Dividends Calculation

The first method that you can use to calculate dividends in a Sacco is the flat rate method. This formula is quite straightforward. You simply take two things into consideration:

- The total amount of shares held by each Sacco members as at the end of the year

- The total amount of profit to be issued as dividends to microfinance bank members

Then, to get the dividends for each member, you simply use the formula below:

Dividends = Shares held by individual member / Total shares held by all members X Amount to be issued as dividends

Problem Sample 1

For instance, ABC Microfinance Bank declared the total dividends to be issued to members as $400,000/=.

The total shares held by all Sacco members in the ABC Microfinance Bank had been calculated as $8,000,000/= as at the end of 2019. Calculate the dividends issued to John Doe who held $150,000/= at the end of that year.

To calculate John Doe’s dividends, simply use the formula outlined above:

Dividends = Shares held by individual member / Total shares held by all members X Amount to be issued as dividends:

Dividends = 150,000 / 8,000,000 X 400, 000

Dividends = $7,500/=

So as you can see above, John Doe pocketed $7,500/= in that year.

Pros of the Flat Rate Method for Dividends Calculation

- Easy to calculate

- Understandable by Sacco members

Cons of the Flat Rate Method for Dividends Calculation

- It is an unfair method that discourages members from saving early in the year since they will get save dividends irrespective of the time period they make savings to the Sacco/microfinance

- This method also ‘eats’ a lot of the Sacco’s reserves or profits especially when members save late in the year and claim dividends at the same rate as those people who saved at the beginning of the year.

Method 2 – Pro-rata Basis Method

The Pro-rata method of calculating dividends in a Sacco involves distributing profits in equal proportion.

In other words, this method allows you to allocate periodic interest rates to members on a monthly basis.

To use this method, you must convert the annual rate of dividends to a monthly rate.

Taking our example above, the ABC Microfinance bank had total outstanding shares of $8,000,000/= at the end of the year.

The total dividends declared by the officials at the end of the year was $400,000/=.

If you look closely at those figures, the company was issuing around 5% as dividends for that year as shown by the formula below.

Dividend rate = 400,000 / 8,000,000 X 100

Dividend rate = 5%

In order to use the pro-rata basis method to calculate dividends for the Sacco members, you must convert the annual rate of 5% to a monthly rate by dividing the rate by 12 months:

- Monthly rate = 5/12

- Monthly rate = 0.42%

So, this means each Sacco member will get dividends at a rate of 0.42% per month.

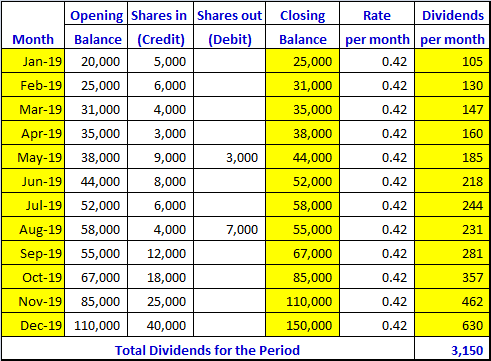

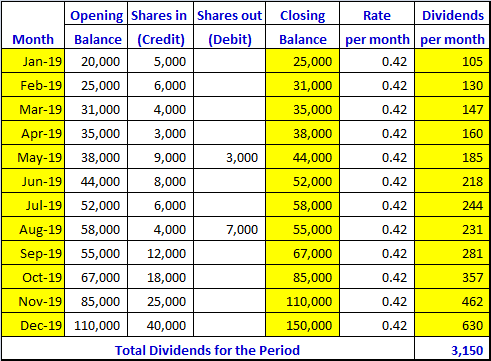

Now to get the dividends for each month, you should take the closing balance at the end of each month for each member and multiply it by 0.42%.

Now, the earlier example in this guide indicated that John Doe had $150,000 at the end of the year.

In order to get his dividends for the year, you need to determine his monthly closing balances from his statement.

The photo below shows John Doe’s closing balances as at the end of every month. To calculate dividends for each month, you simply take the monthly rate calculated earlier as 0.42% and multiply it by the closing balance of the month as shown below:

For instance, the closing balance for John Doe at the end of January 2019 was $25,000, to get dividends for the month, you simply use the formula below

Dividends = 25, 000 X 0.42 / 100

Dividends = $105

Please see the screenshot below:

As you can see from the image above, John Doe earned total dividends of $3,150/= compared to $7,500/= that he could have earned from the flat rate method for dividends calculation.

Pros of Pro-rata Method for Dividends Calculation

- Fairness: This method rewards members who save early into the year and ensure they get the highest yields from their investments

- Another advantage of this dividends calculation method for Saccos is the ability to factor in withdrawals during the period. For instance, in some Saccos, members’ shares may be redeemed to cover late payments for the loans. In such a case, the pro-rate basis method for dividends calculations ensures that the same is reflected on dividends since the method only uses closing balances at the end of the month

Conclusion

In this guide, you used the flat rate and pro-rata basis method to calculate dividends for microfinance, Sacco or a bank.

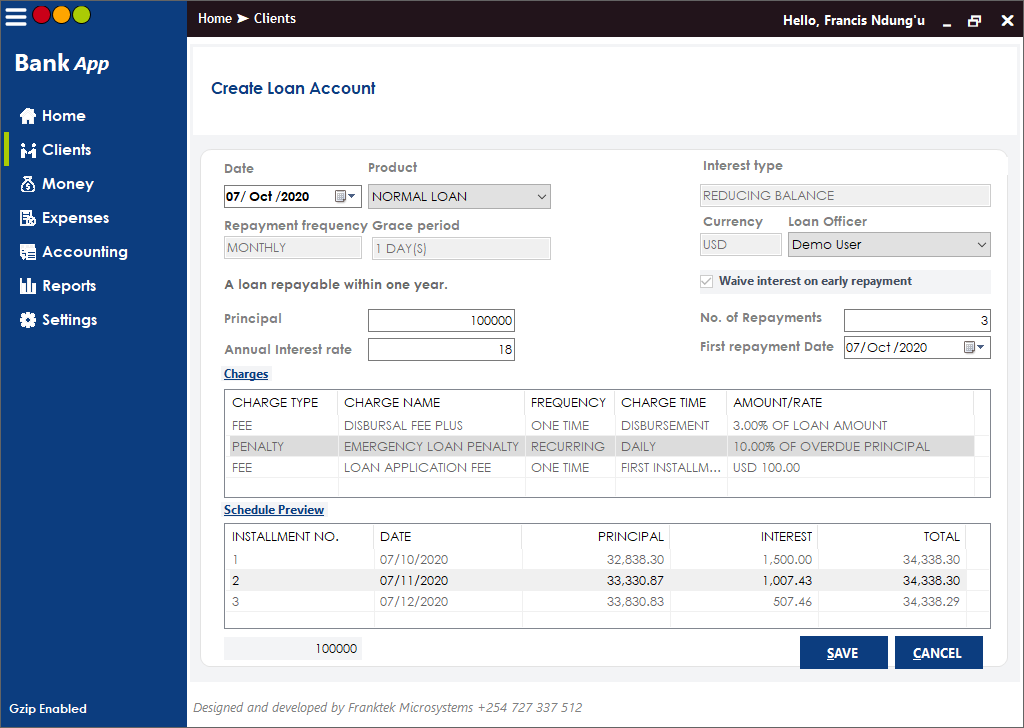

Since each method requires an accurate statement for each member, you should consider purchasing a bank software that takes care of the member’s shares purchases, transfers, and redemptions.

A software like Franktek Sacco Software ensures that you’ve up-to-date statements for Sacco members when calculating dividends.